Compound interest calculator biweekly

TIAA Sixty Second Solution To Estimate How Much You Need To Save For A Goal. To get the exact calculations of the interest rates kindly use the Interest calculator on our website.

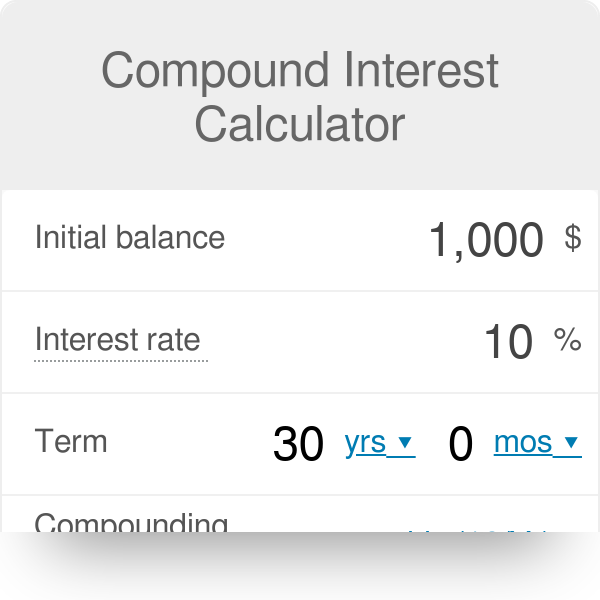

Compound Interest Calculator With Formula

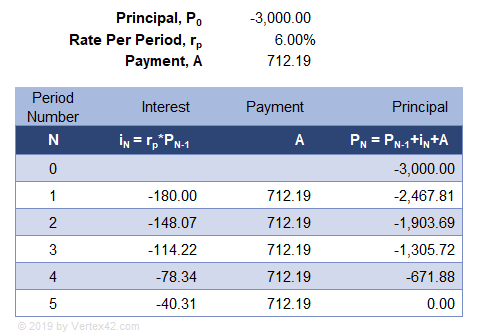

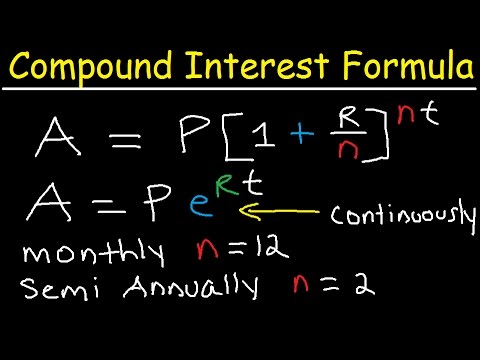

FV PV x 1 in where.

. Formula for compound interest A P 1rnnt Where. The compound interest formula is. Our calculator compounds interest each time money is added.

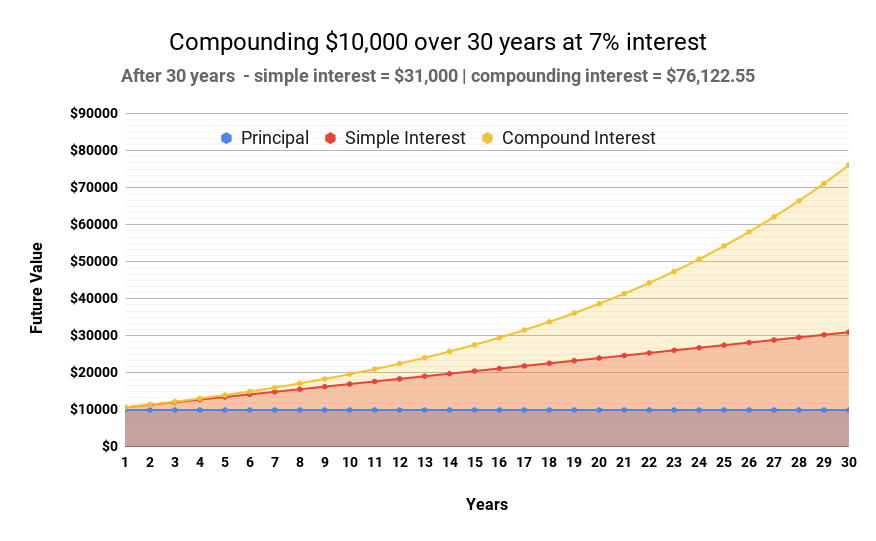

If you started with 10000 you could expect 20000 in nine years 40000 in 18 years 80000 in 27 years and so on. In a flash our compound interest calculator makes all necessary computations for you and gives you the results. To calculate the total compound interest generated we need to subtract the initial principal.

If the investment is compounded monthly. P the principal the amount of. Ad Discover Our Retirement Calculator Financial Tools To Help You Create A Plan.

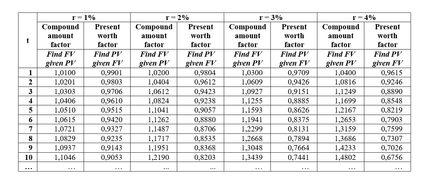

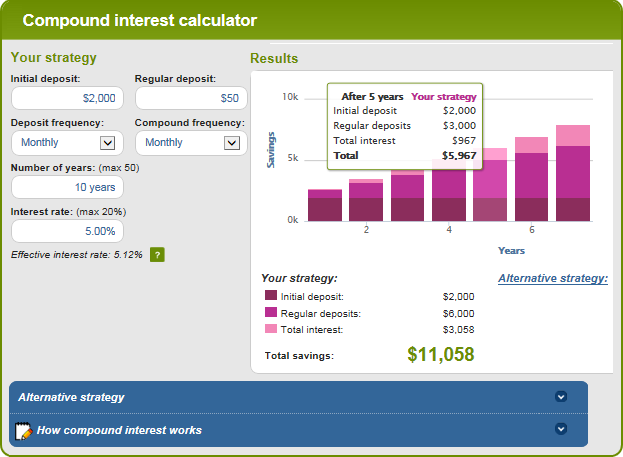

Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning an infinite. The formula to calculate compounding interest is as follows. The Compound Interest Calculator is useful to compare or convert the interest rates of different compound periods.

All you need to do is divide the number 72 by your interest rate. It can be used as a daily compound interest calculator. Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning an infinite number of periods compounding frequencies.

Input interest Compound. In this case Interest amount 1938 1500 438. Next enter how much money you intend to deposit or withdrawal during each biweekly period.

I P 1 rn nt - P 2. The above calculator compounds interest biweekly after each deposit is made. This is the interest received.

Next enter how much money you intend to deposit or withdrawal weekly. Given that the Principal amount is 2000. Compound interest can be computed by multiplying the existing principal sum by one plus the annual interest rate raised by the number of compound periods minus one.

For stock and mutual fund investments you should usually choose Annual. After a year youve earned 100 in interest bringing your balance up to 2100. The two main results are.

100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. Deposits are applied at the beginning of each biweekly period with calculations based on 52 weeks per year even though most years have 1 day more than 52 weeks. The final balance that is the total amount of money you will receive after the specified period and the total interest which is the total compounded interest payment.

If this calculation is for a lump sum deposit with no recurring transactions enter Never in the add money drop down. Find loans for country homes land construction home improvements and more. Ad Determine monthly payments and loan possibilities on country homes and land.

To determine the interest amount. The total amount after 6 years will be approximately 19388. If you dont touch that extra 100 you can then earn 105 in annual interest and so on.

This calculator allows you to choose the frequency that your investments interest or income is added to your account. Output Interest 0. Our Resources Can Help You Decide Between Taxable Vs.

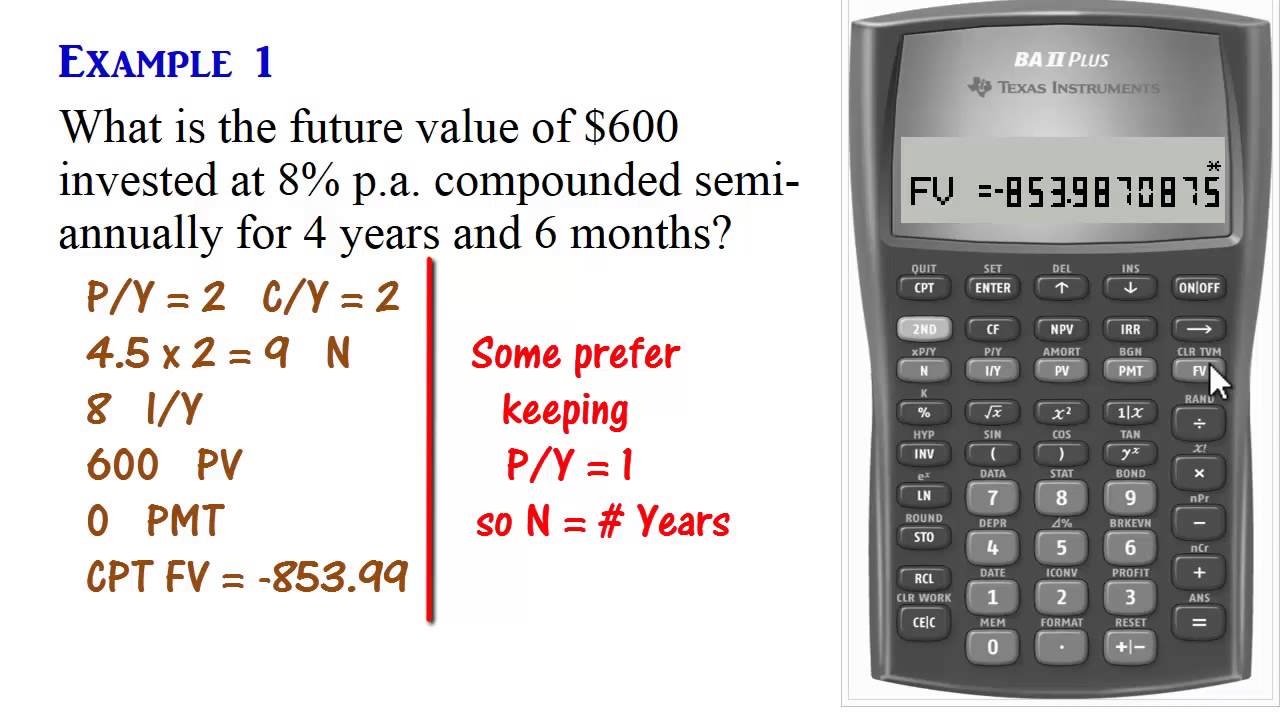

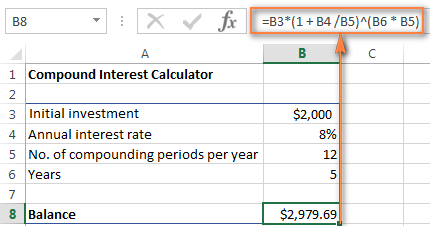

A the future value of the investment or loan P the principal investment or loan amount r the interest rate decimal n the number of times that interest is compounded per period. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. 100 10 110 Derek owes the bank 110 a year later 100 for the principal and 10 as interest.

Use this calculator to quickly figure out how much money you will have saved up during a set investment period. See how much money you would save switching to a biweekly mortgage. A P 1 rnnt The compound interest formula solves for the future value of your investment A.

Compound interest formulas The calculation of compound interest can involve complicated formulas. Even small deposits to a. The cumulative initial amount of the loan is subtracted from the resulting value.

First enter your initial amount you have set aside then enter the interest rate along with how long you intend to invest for. Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning. Principal P 2000 Rate as decimal r 5100 005 Time in months t 12 Adding these into our compounding formula.

The answer tells you will double your investment in nine years. First enter your initial amount you have set aside then enter the interest rate along with how long you intend to invest for. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

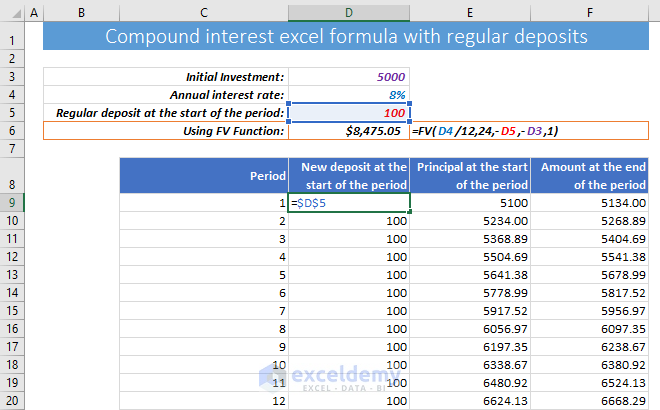

If your interest rate is 8 percent divide 72 by 8. You can also use this formula to set up a compound interest calculator in Excel 1. Lets look at how we calculate the year 20 figure using our compound interest formula.

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an. Find the difference between the compounded amount and the principal amount. The bi-weekly payments are set to half of the original monthly payment which is like paying an extra monthly payment each year to pay off the loan faster save on interest.

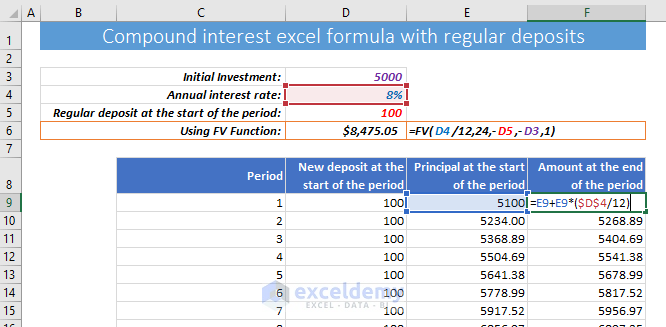

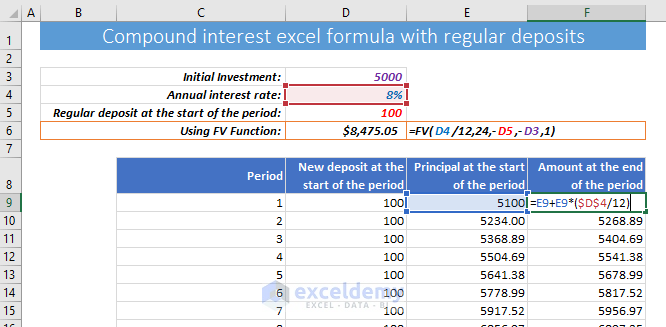

Compound Interest Formula with regular deposits Compound interest for principal equation A P 1 rn nt Future value of a series formula - end of period A PMT 1 rn nt -1 rn. The above calculator compounds interest weekly after each. The above calculator compounds interest weekly after each deposit is made.

This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis. A P 1 rnnt In the formula A Accrued amount principal interest P Principal amount r Annual nominal interest rate as a decimal R Annual nominal interest rate as a percent r R100 n number of compounding periods per unit of time. The more frequently this occurs the sooner your accumulated earnings will generate additional earnings.

To calculate compound interest we use this formula. PV 1 r n FV Where. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth.

Compound Interest Calculator For Excel

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Compound Interest Calculator For Excel

Continuous Compounding Definition Formula

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compound Interest Calculator Getsmarteraboutmoney Ca

Compound Interest Calculator With Formula

Loading Savings Advice Budgeting Money Management

Compound Interest Formula And Calculator For Excel

Compound Interest Excel Formula With Regular Deposits Exceldemy

Compound Interest Formula And Calculator For Excel

Compound Interest Excel Formula With Regular Deposits Exceldemy

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

Our Compound Interest Calculator Not Only Highlights The Value Of Personal Savings It Also Illustrates Interest Calculator Compound Interest Personal Savings

Compound Interest Definition Formula How It S Calculated

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator