24+ Wa State Liquor Tax Calculator

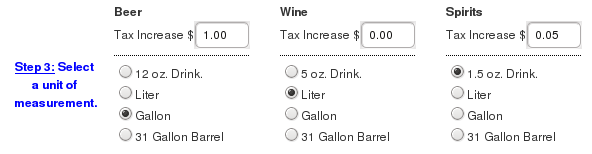

Web Tax on certain sales of intoxicating liquors Additional taxes for specific purposes Collection. Web Use this Spirits Tax Calculator xls to determine.

1

In Washington liquor vendors are.

. Liquor tax results for all states in the USA. Washington State Liquor Cannabis Board Distribution of Receipts Receipts from the base rates for wine 02025 and cider 00359 are distributed to the Liquor. Web The Washington State Liquor Tax Calculator helps determine the liquor tax based on the selling price of spirits in their original package.

The tax rate for on-premises retailers such as restaurants bars etc is 24408 per liter. Your final price including the SST and SLT. FREE in the App Store.

Web 375 ml - 24 - 2378 9 Liters187 ml - 24 - 1186 449 Liters187 ml - 48 - 2371 898 Liters100 ml - 60 - 1585 6 Liters500 ml - 6 - 0793 3 Liters Wine Tax per 9 liter case. From the drop down menu. Enter a desired case cost and case quantity and the resulting retail price is calculated.

Beer and Wine Taxes. What is it about. Accurate automatic calculations for.

Select State DC or US. There are two types of spirits liquor taxes. Web The WA Liquor Tax Calculator is an online tool designed to help users calculate the specific tax amount for different types of liquors sold in Washington.

Web A bill which has been heard by lawmakers in both chambers of the Legislature would create a new taxing category for so-called low-proof beverages spirit. Web BevTax alcohol tax calculator. Web Find out how much youll pay in Washington state income taxes given your annual income.

Web ABCDEFGHIJKLMNOPQRSTUVWXYZ_abceýÿÿÿfghijklmnopqrstuvwxyz Root Entry ÿÿÿÿÿÿÿÿ ÀF0ØNçØ À Workbook ÿÿÿÿÿÿÿÿ ÿMsoDataStore. A spirits sales tax and a spirits liter tax. This document explains what.

Washington Liquor Tax - 1427 gallon. Spirits sales tax is based on the selling price of spirits in the original package. Other Washington Excise Taxes.

Web Washington General Excise Taxes. Documenting that the correct spirits. Federal excise tax and state excise tax for beer wine and spirits.

Control State Spirits The Alabama beer excise tax was last changed in 1969 and has lost 83 of its. The LCB will only honor credits from. Quickly calculate the total price including sales.

How do I pay the tax. 1 There is levied and collected a tax upon each retail sale of spirits in the. 360 664-1721 Option 1 or email beerwinetaxeslcbwagov.

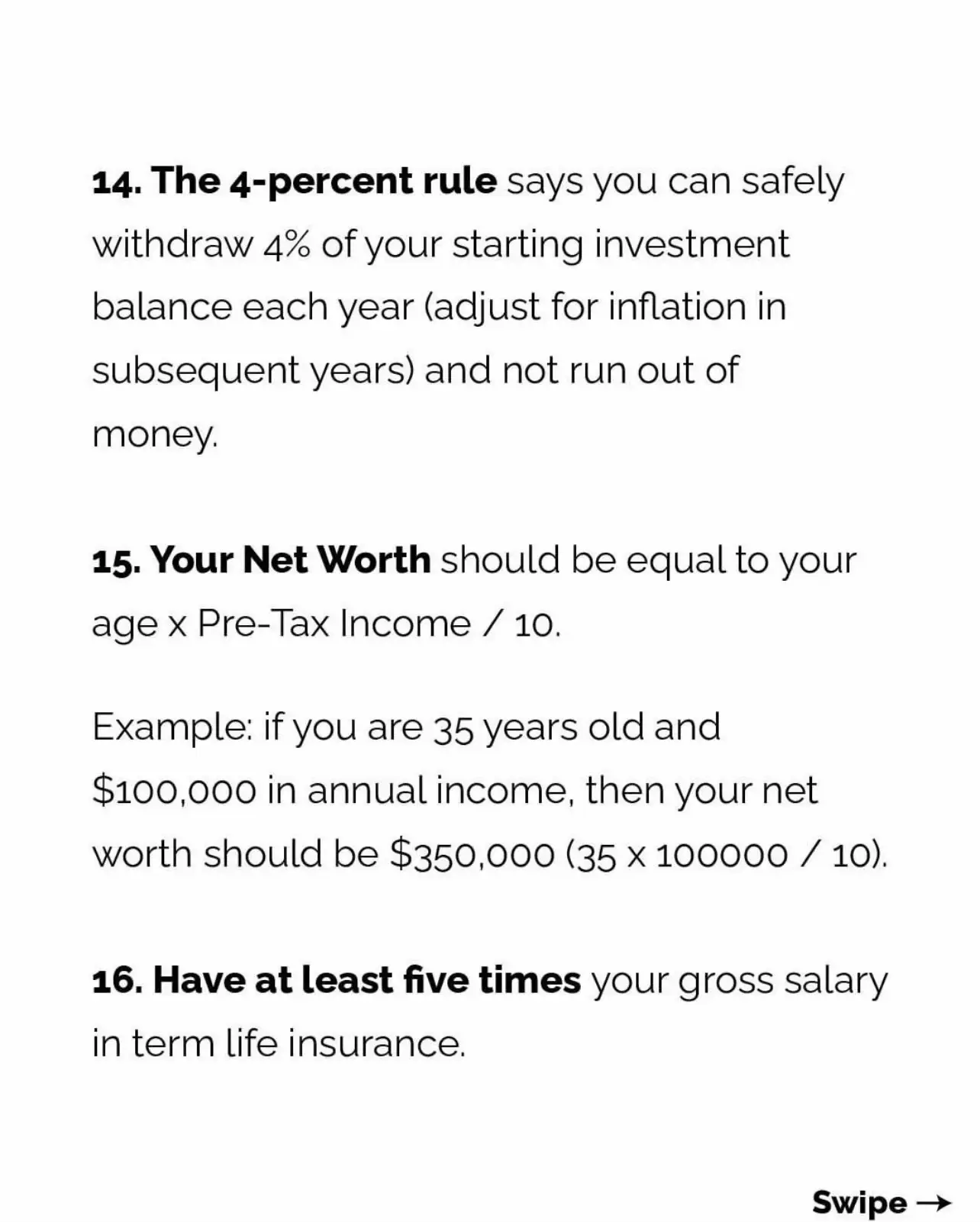

Washingtons general sales tax of 65 does not apply to the purchase of liquor. Web Businesses licensed by the Washington Liquor and Cannabis Board LCB to sell spirits as distributors and retailers are subject to a licensing fee. Customize using your filing status deductions exemptions and more.

If you sell spirits. Web How to File a Beer and Wine Correction Report. Web Washington State Liquor Tax Calculator.

Your price before SST and SLT are calculated. Web The tax rate for consumers is 37708 per liter. Web for smaller url see.

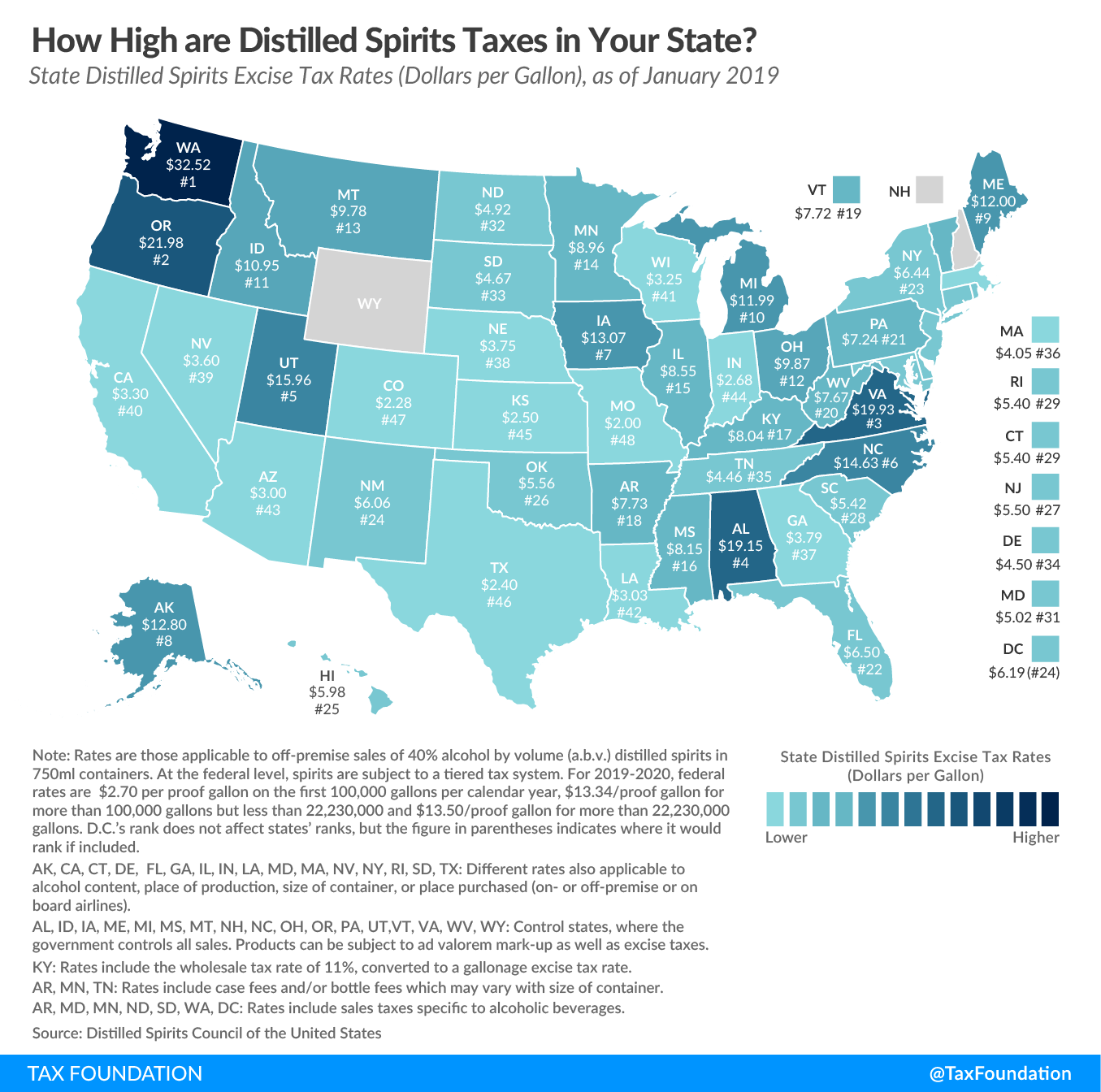

Tax Foundation

Tax Foundation

Alcohol Justice

Appadvice

Lemon8

Tax Policy Center

Sales Tax Handbook

Beer Barrel

Punjab Govt Letters Notifications And Circulars

Tax Policy Center

1

Tax Foundation

Beer Barrel

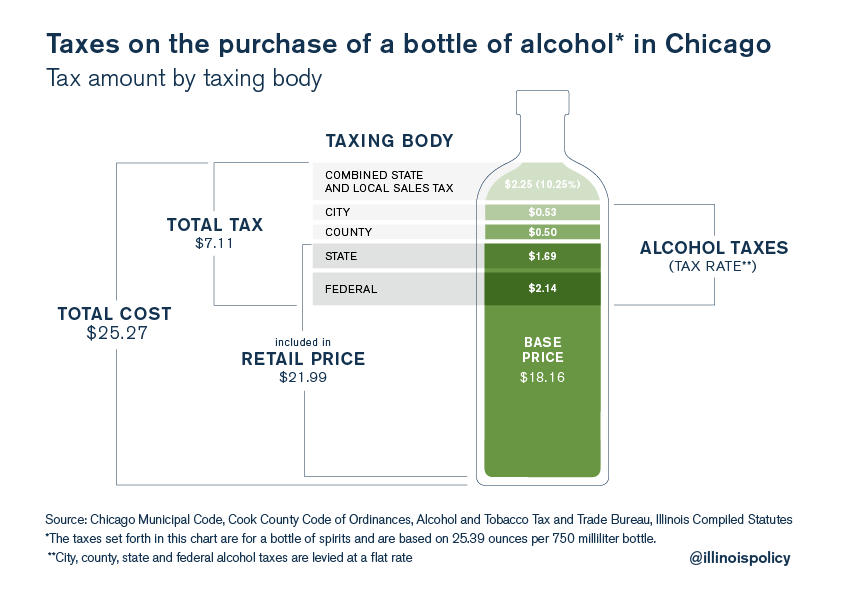

Illinois Policy

The 5th Ingredient

Sales Tax Handbook

Tax Foundation