40+ mortgage interest deduction limitations

The IRS has a deduction limit. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Web Limits on the mortgage tax deduction have come about because of rising home prices.

. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Calculate Your Monthly Loan Payment. Homeowners who bought houses before.

Web mortgage interest deduction limit home mortgage interest limitation calculation mortgage interest deduction limit refinance mortgage interest deduction. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Homeowners who are married but filing.

Web There isnt a limit on the amount of interest you can deduct from grandfathered debt. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web There is a limit to how much interest you can deduct so be sure to keep track of how much you are paying in interest each year.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Discover Helpful Information And Resources On Taxes From AARP. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. See If Youre Eligible for a 0 Down Payment.

The limit means that now married. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It was estimated that the mortgage interest deduction cost the federal.

Web You arent limited to deducting the interest on the first home. Investment interest limited to your net investment. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

However grandfathered debt can reduce your home acquisition debt. If itemizing a single filer would. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web You also cant deduct the interest on any portion of your mortgage debt that exceeds 750000 375000 for single taxpayers or married taxpayers who file. Ad Shortening your term could save you money over the life of your loan. You can deduct interest paid on a second home up to the annual limit.

Web The mortgage interest tax deduction limit was 1 million prior to the signing of the TCJA but is now limited to 750000. Web The deduction for home equity interest may be reduced even below the 100000 limit if the indebtedness exceeds the fair market value of your home.

Top Tax Write Offs And Deductions For Freelance And Work From Home Employees Hubpages

Oibda Examples Advantages And Limitations Of Oibda

Why The Ideal Income Is The Student Loan Forgiveness Income Threshold

Mortgage Interest Deduction Changes In 2018

Gutting The Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Mortgage Interest Deduction Limit And Income Phaseout

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Mortgage Interest Deduction A 2022 Guide Credible

Heritage Home Loans Hhlnorthwest Twitter

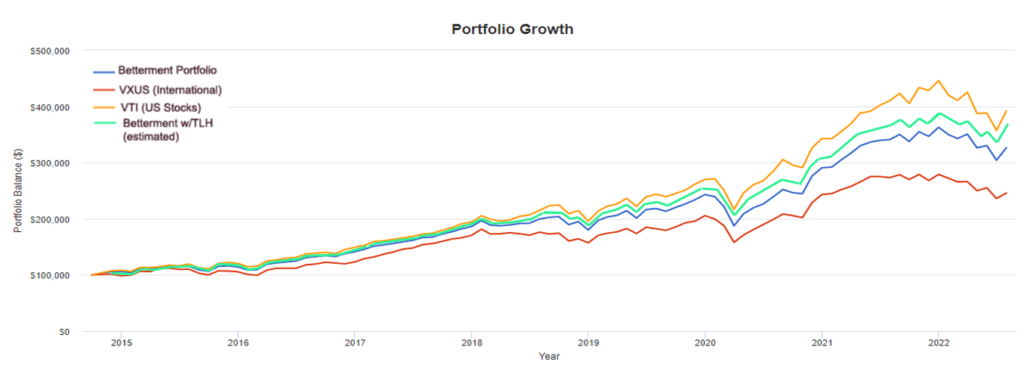

The Betterment Experiment Results Mr Money Mustache

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Mortgage Interest Deduction What You Need To Know Mortgage Professional

The Home Mortgage Interest Deduction Lendingtree

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center